Understanding Health Insurance Health insurance provides financial coverage for medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. Plans vary in terms of cost, coverage, and provider networks. Understanding these variations is crucial to selecting the best option. Factors to Consider When Choosing a Plan Premiums – …

Read More »The Importance of Health Insurance in Today’s World

Introduction In the modern world, health insurance has become an essential aspect of financial and physical well-being. With the rising costs of medical treatments, increasing prevalence of lifestyle diseases, and unpredictable health emergencies, having a health insurance policy is more crucial than ever. This note explores the significance of health …

Read More »Comparing Health Insurance Plans: What to Look For

Introduction Choosing the right health insurance plan is crucial to ensuring adequate medical coverage while managing costs effectively. With numerous options available, it is important to carefully compare plans based on key factors such as premiums, coverage, deductibles, and network providers. This guide will help you understand what to consider …

Read More »How Health Insurance Protects You and Your Family

1. Financial Protection from Medical Expenses Medical treatments can be expensive, and unexpected illnesses or accidents can result in high costs. Health insurance helps cover expenses such as: Doctor visits Hospital stays Surgeries Medications Diagnostic testsBy reducing out-of-pocket costs, insurance prevents you from depleting your savings or going into debt …

Read More »The Benefits of Having Health Insurance

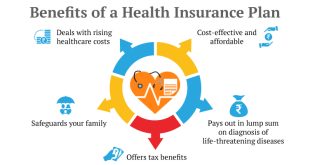

Introduction Health insurance is a crucial financial tool that provides individuals and families with access to medical care while protecting them from high healthcare costs. It serves as a safety net that ensures people receive timely medical attention without suffering a financial burden. Below are the key benefits of having …

Read More »Choosing the Right Health Insurance Plan

1. Assess Your Healthcare Needs Consider your medical history, existing health conditions, and the frequency of doctor visits. Evaluate the needs of your family members if choosing a family plan. Determine the types of medical services you may require, including prescription drugs, mental health support, or maternity care. 2. Understand …

Read More »Health Insurance 101: Everything You Need to Know

What is Health Insurance? Health insurance is a contract between an individual and an insurance provider that helps cover medical expenses. It provides financial protection against high healthcare costs by covering services such as doctor visits, hospital stays, medications, and preventive care. Why is Health Insurance Important? Financial Protection – …

Read More »Protecting Your Tech Investments: A Comprehensive Guide to Technology Insurance

Understanding Technology Insurance Technology insurance is designed to protect against risks associated with technology-related products. Coverage can include physical devices (like computers and smartphones), software, data loss, and liability claims arising from technology use. Technology insurance typically falls into a few broad categories: 1. Property Insurance Coverage for Physical Devices: Protects …

Read More »Assessing Your Risk: When to Consider Technology Insurance for Your Business

Why Consider Technology Insurance? Technology insurance provides coverage for losses or damages related to your business’s technology assets, including: Hardware and equipment failure: Protect your business from financial losses due to equipment failure, theft, or natural disasters. Cyber attacks and data breaches: Safeguard your business against costly cyber attacks and …

Read More »The Importance of Technology Insurance in a Remote Work Environment

Introduction As remote work becomes increasingly prevalent across various industries, the reliance on technology has surged. Consequently, organizations must recognize the importance of technology insurance to safeguard their operations, data, and overall business continuity. Below is a comprehensive overview of the significance of technology insurance in a remote work environment. …

Read More »