Introduction In the world of culinary arts, recipes are more than just instructions—they are creations born of innovation, experimentation, and passion. As intellectual property, recipes deserve the same level of protection as any other creative work. Tried and Insured introduces a unique concept: Recipe Protection Plans that cater specifically to …

Read More »Cooking Covered: Your Recipes, Our Protection

Introduction: Cooking Covered: Your Recipes, Our Protection” embodies the perfect blend of culinary creativity and safety consciousness. This initiative focuses on ensuring your passion for cooking thrives while maintaining a safe and enjoyable environment in the kitchen. It’s more than a tagline; it’s a commitment to empowering home cooks and …

Read More »Culinary Security: Recipes You Can Count On

1. Defining Culinary Security Culinary security refers to the assurance that a recipe will consistently produce a reliable and desirable outcome. It involves more than just the correct blend of ingredients; it encompasses precision, safety, adaptability, and clarity, ensuring that anyone following the recipe can achieve the intended result. 2. …

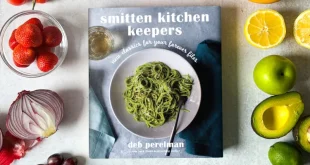

Read More »Cookbook Keeper: Protect Your Precious Recipes

Introduction Cookbooks and recipes are more than just instructions for preparing meals; they are carriers of tradition, memories, and creativity. Whether handwritten by a loved one, clipped from magazines, or crafted through personal experimentation, recipes hold a special place in our hearts and homes. The Cookbook Keeper is a thoughtful …

Read More »Kitchen Legacy: Recipe Insurance for Generations

The Importance of a Kitchen Legacy A kitchen legacy refers to the intangible inheritance of recipes, cooking techniques, and culinary wisdom passed down through generations. It encompasses the secrets of a grandmother’s pie crust, the exact blend of spices in a family curry, or the seasonal traditions tied to specific …

Read More »Technology Business Interruption Insurance: Covering Lost Revenue Due to Technology Failures

What is Technology Business Interruption Insurance? TBI insurance is a specialized coverage designed to compensate businesses for lost revenue and additional expenses incurred due to technology-related disruptions. This coverage goes beyond traditional business interruption insurance, which often focuses on physical damage to property. TBI insurance specifically addresses the unique challenges …

Read More »Cyber Extortion Insurance: Protecting Against Extortion Threats

What is Cyber Extortion Insurance? Cyber extortion insurance is a specialized type of insurance policy designed to protect businesses against financial losses incurred due to cyber extortion attacks. It covers various expenses, including: Ransom payments: Reimbursement for the ransom demanded by cybercriminals. Forensic investigation costs: Expenses related to investigating the …

Read More »Technology Errors and Omissions Insurance: Minimizing the Cost of Mistakes

What is Technology E&O Insurance? Technology E&O insurance is a specialized form of professional liability insurance designed to protect businesses that provide technology products or services. It covers claims arising from errors, omissions, or negligence in the design, development, manufacture, distribution, or sale of technology products or services. Key Coverages …

Read More »Hacking Insurance: Covering the Costs of Hacking Attacks

1. What is Hacking Insurance? Hacking insurance, or cyber insurance, is a policy designed to help organizations cover the financial costs incurred due to cyberattacks, including hacking incidents. This form of insurance typically covers a wide range of cyber risks, such as data breaches, network damage, extortion, and loss of …

Read More »Data Privacy Violation Insurance: Covering the Costs of Data Privacy Violations

Introduction In today’s interconnected world, where digital transformation is at the forefront of business strategy, the importance of data privacy has never been greater. With the increasing reliance on digital platforms and cloud-based services, businesses collect, store, and process vast amounts of personal and sensitive information. This data, which may …

Read More »